How This Woman Paid Off $26K in Debt in Under 3 Years on a Single Income

Kayla Higginbotham was chatting with a friend around Christmas of 2015 about how she made the minimum payment of about $300 on her student loans every month, yet never seemed to make headway on the principal.

Her friend, a math teacher, calculated how much interest she’d pay in total if she continued to pay that minimum. Then he showed her what it would be if she paid an extra $100 or $200 per month.

Higginbotham realized if she continued to make minimum payments, she’d pay more in interest by the time she paid off her loan than what she originally took out for her degree.

“I’m just a super visual person,” Higginbotham said. “So seeing those numbers on paper just gave me a super clear understanding of where my money was going.”

Higginbotham’s debt totaled $45,000 — $38,000 in student loans and $6,000 on her car. Because she didn’t make much more than $45,000 annually, she knew she could only start small.

“I’m going to be determined,” she told herself. “Even if it just means $10 more a month, you know? Whatever I can afford.”

The First Steps She Took to Pay Down Debt

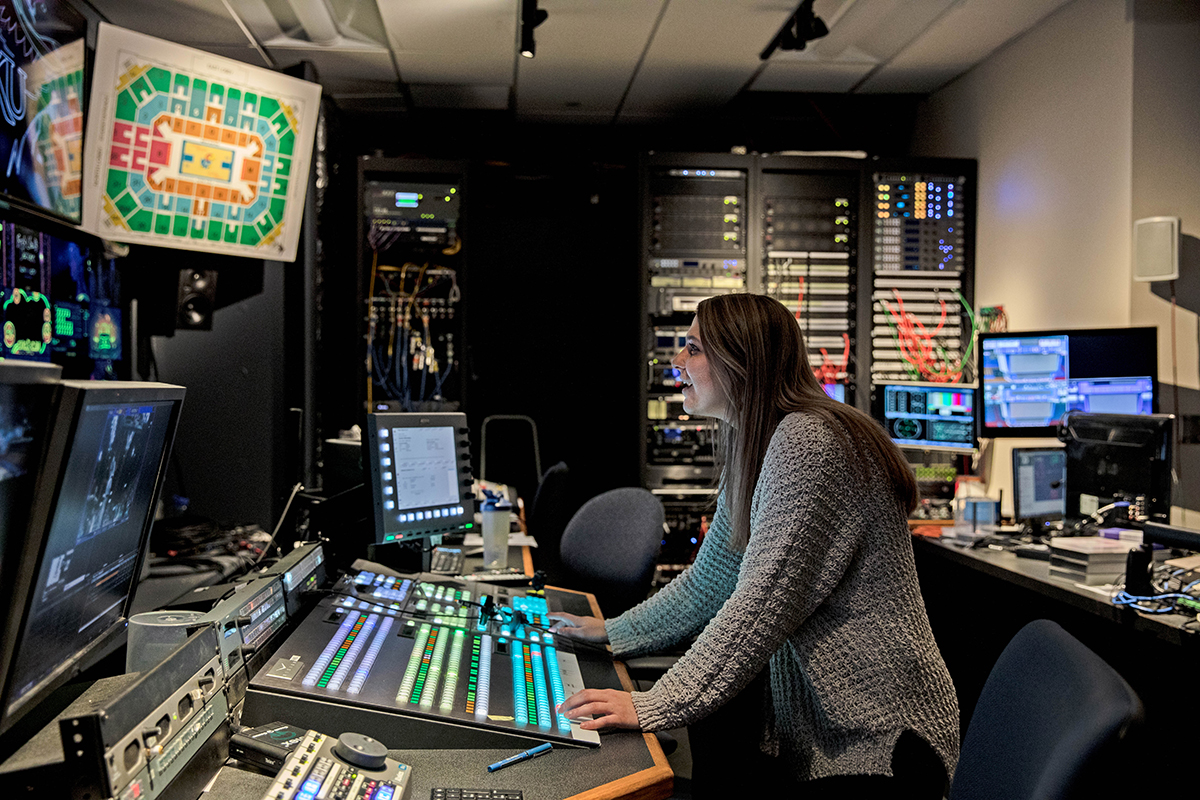

At the time, Higginbotham led video production for University of South Florida Athletics in Tampa, Florida. She was living by herself in an apartment with her dog, Brooke.

A few months later in March 2016, Higginbotham got a job offer to be the production manager for athletics at the University of Kansas, her alma mater.

She loved Tampa, but the cost of living and her long commute had her living paycheck to paycheck.

While the position didn’t offer a big pay raise, she accepted it because she knew moving would allow her to make and save more money.

“I was getting a strong network in Tampa, but I wasn’t quite there,” she said. “In [the] Kansas City metropolitan area, I had a really big network for side-hustle jobs.”

Higginbotham was eventually able to call on friends and colleagues. She offered her video production services for events and weddings. Now, she makes about $6,000 per year just for her side hustling.

But before she could drum up video business on her own, Higginbotham spent a summer working at an escape room to put more money toward her loans.

She also found ways to save money.

Higginbotham spent four months living at home with her parents until affordable leases for the academic year opened in August 2016. The move allowed her to pay off her car loan. She also didn’t go out to lunch with her co-workers.

“Every time we go out for lunch, I’m spending about 10 bucks,” she said. “So [if] you’re talking every day of the week, 50 bucks a week, $200 a month. Which is pretty unbelievable to think that you could spend $200 a month on lunches.”

Once she got an apartment near the university, she saved on transportation costs. To save on rent, she had a roommate for two years.

The small things added up. In October 2018, she hit the milestone of paying $20,000 toward her student loans, with $18,800 left to go.

Her Goal: Be Debt-Free by March 2020

Higginbotham has had to push back against well-meaning friends — and even her own impulses — who think she should buy a home.

It’s a goal she has for the future, but she wants the freedom of not being tied to financial obligations even more than she wants a house.

“I feel I’m willing to sacrifice now, knowing what’s waiting for me on the other side of this,” she said.

Higginbotham plans to be debt-free before her 31st birthday in March 2020.

It’s a slow road that she admits continues to be difficult.

“When you first start this journey, it’s really exciting,” she said. “And you think it’ll be exciting the whole time, which just frankly isn’t the case.”

But she still celebrates every win and milestone, whether through a text to a friend or having beers at a bar.

“I blow my budget more times than I’m proud of, and I haven’t been perfect,” she said. “This has been a messy process with lots of failures, but I haven’t let that stop me.”

Jen Smith is a staff writer at The Penny Hoarder. She gives money-saving and debt-payoff tips on Instagram at @savingwithspunk.