This App Helps You Avoid a Panic Attack When the Cashier Gives You Change

Pulling out exact change is nothing short of a miracle.

Especially when you’re receiving sharp glances from people in line behind you.

But we don’t appreciate our coins enough. Americans left behind $867,812 worth of coins at the airport and threw away an estimated $62 million worth of change in a single year.

Poor pennies.

That’s what led entrepreneur Jeff Witten to create an app that would help people pay in cash without worrying about burdensome change.

“As a student I loved to use cash,” Witten said. “For me, it was the easiest way to budget. But one thing I always hated was getting change back. There was no place I was using coins. I talked to friends and classmates, and found out there was a universal disdain for coins. Cash is still very sticky, and people like to use it. People who get paid in cash spend it; they don’t put it in the bank. People shouldn’t have to pay 11% at a coin machine to turn their money into usable money.”

Thus CoinOut was born. It’s a free micro-savings app that becomes a digital wallet by storing loose change and cash back at participating stores.

The app debuted to the public on the Feb. 18 episode of “Shark Tank,” during which it accepted a $250,000 offer from Robert Herjavec.

Here’s how it works: When you pay for something in cash — say it costs $3.43 — you can hand the cashier a $5 bill, and instead of getting a dollar, two quarters, one nickel and two pennies back ($1.57), the cashier can select “CoinOut.” Then, you scan your phone to have the $1.57 deposited into your CoinOut digital wallet.

You can cash out your wallet in-store, into your bank account, or by redeeming it for gift cards or donating it to charity.

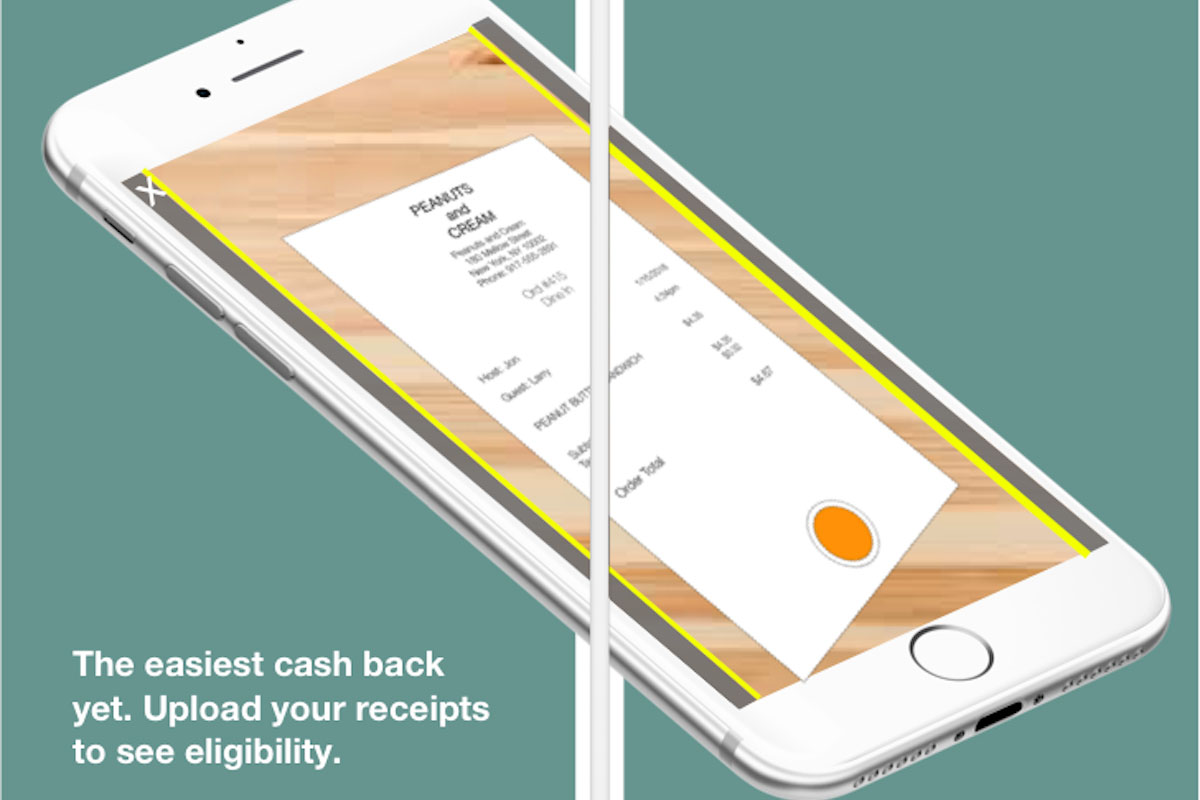

In addition to storing change in your CoinOut wallet, you can also use the app to earn cash back. Use your phone to take pictures of receipts at participating merchants, and the cash back is added to your wallet.

With only 7% of Americans taking advantage of apps to help them save money, Witten hopes that CoinOut will make savings and rewards more accessible to the people who need it most.

“I think that when we look at the financial payment space, it seems a little bit broken,” he said. “There are people who use cash who can’t get credit cards. We wanted to help these people get access to tool that helps them save money. People of lesser means shouldn’t be paying higher fees.”

Jen Smith is a junior writer at The Penny Hoarder and gives money saving and debt payoff tips on Instagram at @savingwithspunk. Senior writer Tyler Omoth contributed reporting.